MicroStrategy’s Latest Bitcoin Acquisition

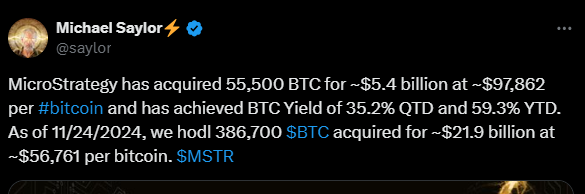

MicroStrategy has made headlines once again by acquiring an additional 55,500 bitcoins for approximately $5.4 billion. This latest purchase was executed at an average price of $97,862 per bitcoin, demonstrating the company’s unwavering belief in the asset's long-term value.

A Growing Bitcoin Treasury

With this acquisition, MicroStrategy now holds a staggering 386,700 bitcoins, acquired at a cumulative cost of $21.9 billion. The average price per bitcoin for its entire portfolio stands at $56,761, underscoring its strategic entry points over time.

Impressive Yields: QTD and YTD Performance

In addition to growing its holdings, MicroStrategy has reported stellar Bitcoin yields: 35.2% quarter-to-date and 59.3% year-to-date. These figures highlight the company's successful approach to leveraging Bitcoin's market performance for shareholder value.

Strategic Vision Under Michael Saylor

Executive Chairman Michael Saylor has been a pivotal figure behind this bold strategy. A well-known Bitcoin advocate, Saylor has consistently championed the asset as a superior store of value compared to traditional reserves, positioning Bitcoin as a cornerstone of MicroStrategy’s corporate treasury.

Institutional Confidence and Market Implications

MicroStrategy’s continued investment reflects growing institutional confidence in Bitcoin, particularly as it edges closer to the $100,000 milestone. The company’s actions could inspire other corporations to adopt similar strategies, potentially accelerating the mainstream adoption of cryptocurrencies.

Looking Ahead

This acquisition aligns with MicroStrategy’s long-term plans to expand its Bitcoin reserves, further solidifying its position as a pioneer in corporate cryptocurrency investment. As the market evolves, the firm’s aggressive strategy may shape the future of digital asset adoption in traditional financial systems.

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  Shiba Inu

Shiba Inu  Pepe

Pepe  Bonk

Bonk  dogwifhat

dogwifhat  Popcat

Popcat